6 November, 2023

Newsletter October 2023

As you know Eurobattery Minerals has been active in three European countries: Finland, Spain, and Sweden. We are certainly furthest along in Finland, where exploration is largely complete and most of the licenses are in place. If everything goes as planned, we can start building production facilities very soon. The Spanish authorities are making us wait a bit, but there too we are confident of getting to a concrete operational phase very soon. We are furthest away from our goals in Sweden, which is particularly sad for us as a Swedish company. We have therefore decided not to renew exploration licenses for our seven Swedish assets to create better shareholder value. This decision is based on current challenges associated with mining in Sweden, where the uncertainty in the permit process adds vast ambiguity to the investment case. Instead, we concentrate on our well-advanced battery mineral mine projects in Hautalampi in Finland and Corcel in Spain, where analyses point to high nickel, copper, and cobalt grades with a strong economic outlook. We did not take this decision lightly, but we must join forces where success is most tangible! For the benefit of all of us.

A shared vision: expanding the cooperation with Uppsala University

Research needs business and business needs research. Developing more efficient methods for exploration or new technical processes for extracting important minerals are complex and expensive, but essential. This is where companies like us at Eurobattery Minerals come in. For some time now, we have been working with one of the oldest universities in Scandinavia, Uppsala University. So far, our research goal has been to investigate possibilities for large-scale extraction of rare earth elements (REE) using existing methods. Now we can call ourselves an official partner of the Smart Exploration Research Centre. The project aims to gather leading experts over six years to achieve scientific breakthroughs and technological leaps in the exploration and refining of metals and minerals. The research center is funded by the Swedish Foundation for Strategic Research with 60 million SEK (approx. 5 million euros). This investment shows even more how important the domestic production of minerals is now considered to be. The knowledge, expertise, and solutions developed in academia are for the benefit of all.

China's strategy for strategic minerals

The race for our planet's resources has not just begun – we are right in the middle of it. The Middle Kingdom, China, is the world's largest producer of graphite. It is estimated that around 850 thousand tons of important battery raw materials are produced in mines here every year. This accounts for around 65 percent of global graphite production. In total, the country processes more than 90 percent of the world's graphite into material. Two other figures are not insignificant: an average lithium-ion battery contains 52 kg of the mineral, which means that graphite accounts for 28.1 percent of a battery. The black carbon is considered particularly conductive.

Now China is restricting exports of the raw material, which is important for batteries in electric vehicles. From 1st December, domestic exporters will have to obtain an export license for several graphite products, as announced by the Ministry of Commerce in Beijing. The aim is to ensure the security and stability of the global supply and industrial chain. However, experts see the export controls as a reaction to US sanctions in the technology sector. European economists are concerned about the development because a free global exchange of goods is essential for the green transformation.

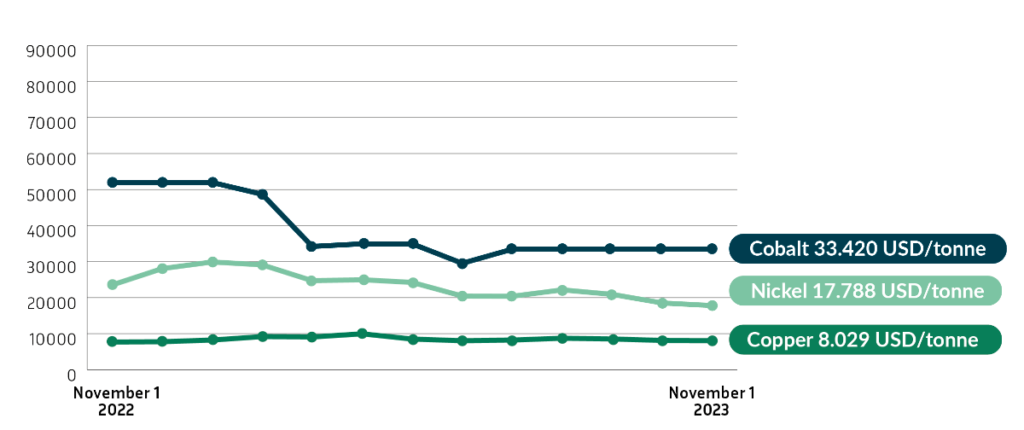

Different mineral, similar intentions: China plans to increase its cobalt reserves. The National Food and Strategic Reserves Administration, which manages the state's raw material stocks, had agreed to buy about 3,000 tons of the important battery mineral. Cobalt was designated as critically important by the EU only this year under the Critical Raw Materials Act. Here, "economic importance" and "supply risk" serve as important parameters in determining criticality. Glencore, one of the world's two largest cobalt producers, said in August that a mix of "strategic and proactive stockpiling" around the world would help rebalance the cobalt market.

EU battery regulation as an incentive system for China

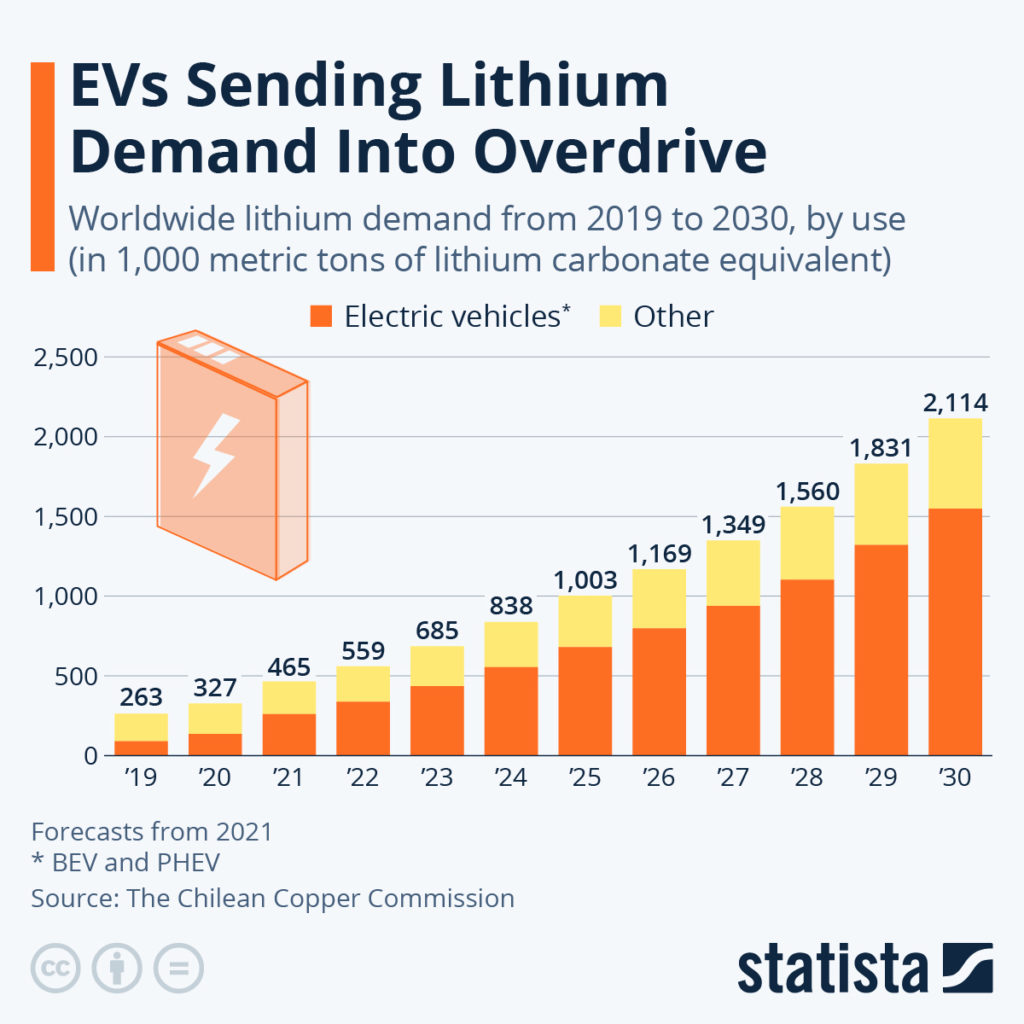

The race for market share in the EV market and thus the battery market against China has long since begun. The European Battery Directive therefore not only aims to protect the environment and human rights along the value chain but is also a strategic instrument for securing Europe's position in the battery business. By 2030, demand for lithium-ion batteries will increase by 27 percent annually, a McKinsey study reveals. Overall, the EU relies on 4 key instruments within the Battery Regulation: information on the carbon footprint and a digital product passport for each battery, targets for recycling efficiency and material recovery, as well as the liability of marketers along the entire value chain for social and environmental risks.

One might think that this pressure situation would give China stomach pain. However, the ambitious player from the East sees the battery regulation as an incentive system to meet European demands. In April, the major Chinese battery manufacturer CATL announced its intention to make its core business CO2-neutral by 2025 and to achieve carbon neutrality in the entire battery value chain by 2035, for it is also clear that the Battery Ordinance will be difficult to meet without Chinese investment. According to experts, additional investments of 62 billion Euros would be needed by 2030 to meet the targets of the battery regulation: 44 billion in cell production, 12 billion in cathode material production, and 6 billion in anode material production. This is one of the reasons why investments from China in the battery sector are increasing. We cannot do it with or without the giant from Asia - it is important to promote European projects to reduce our dependence strongly.

Apropos batteries: In the future, the research and development project for the production of lithium-ion batteries for electric vehicles of the French battery manufacturer Verkor will be supported with 659 million euros. The measure is part of the French transformation plan "France 2030". We at Eurobattery Minerals welcome the strengthening of the European battery market.

CRM-Club

To reduce dependence on third countries to access critical raw materials, the EU is currently discussing some concrete objectives to decouple. One of them: The “Critical Raw Materials Club” for all like-minded countries. The first meeting of the exclusive club members will take place before the end of the year, EU Internal Market Commissioner Thierry Breton has announced.

EU Internal Market Commissioner Thierry Breton.

The club, which will include resource-rich countries and consumer countries, will improve cooperation on raw materials policy, spur investment, and support resource-rich countries in their goal to build local processing capacity, Breton said. The initiative is part of the Critical Raw Materials Act. Welcome to the club! According to a research paper by the Jacques Delors Centre, the Club is a promising model for successful commodity diplomacy. However, for this to happen, the EU would “need to provide credible initial funding when the club is established and streamline its fragmented model of development finance”. Word!

I wish you all a peaceful and stress-free autumn and a reflective pre-Christmas period.

Svenska

Svenska

Deutsch

Deutsch