9 October, 2023

Newsletter September 2023

The summer is drawing to a close. As a recommended read, I would like to draw your attention to the opinion of mining veteran Chris Hilde (former mining director), which he shares in the Financial Times. Among other things, he calls for a fundamental rethink in the mining industry, identifies safety and ESG standards as a given in mining, and emphasizes the importance of collaboration with local stakeholders for the successful implementation of projects. Read more here.

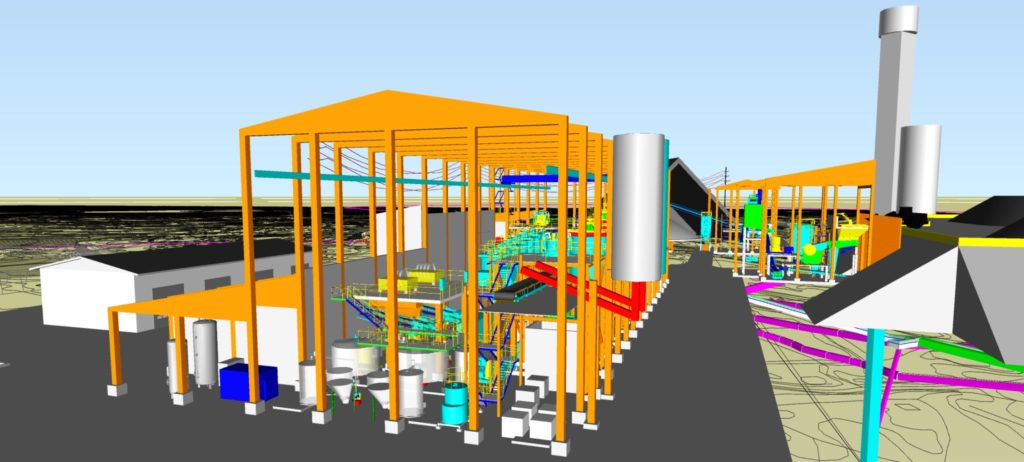

Hautalampi: Development of the first cobalt-nickel-copper concentrator

Good news from Hautalampi: The Cobalt-Nickel-Copper initial concentrator process design is nearly ready thanks to AFRY and Arto Laukka. The plant extracts and concentrates the ore from its source to extract valuable metals such as cobalt, nickel and copper. A little technical know-how about the tasks of the concentrator:

- Crushing: the ore is first crushed to reduce its size and make it suitable for further processing.

- Processing: The crushed ore is then processed to separate it from unwanted accompanying minerals, rock and other impurities. This can be done by flotation, gravity separation, magnetic separation or other processes, depending on the specific properties of the ore.

- Concentration: Here copper flotation concentrates are produced, as well as nickel-cobalt flotation concentrates. This can be achieved through various chemical and physical processes to separate and enrich the desired metals.

The design parameters are largely based on pilot test work conducted by Geological Survey of Finland (GTK) / Geologian tutkimuskeskus (GTK) and experience from former Keretti operation with similar ore. The concentrator is designed to produce 11,400 tons of nickel and 2,900 tons of cobalt in nickel-cobalt concentrate and 9,600 tons of copper in copper concentrate over the expected 12-year mining period. The total planned capacity of the plant is 500,000 tons per year. The expected production numbers are a promising sign for Eurobattery Minerals and FinnCobalt Oy as we continue our journey to supply Europe with key battery metals.

Roundtable at the coffee shop

Last week our team had a productive discussion about the Hautalampi mining project, covering topics such as environmental impact assessment, permit applications, water management, and lake sysmäjärvi improvement actions. Special thanks to the local people from Outokumpu for their valuable input. Our roundtable always takes place on every first Tuesday of the month – if you are interested in joining us in Finland, don't hesitate! We are happy to see every new face in this roundtable.

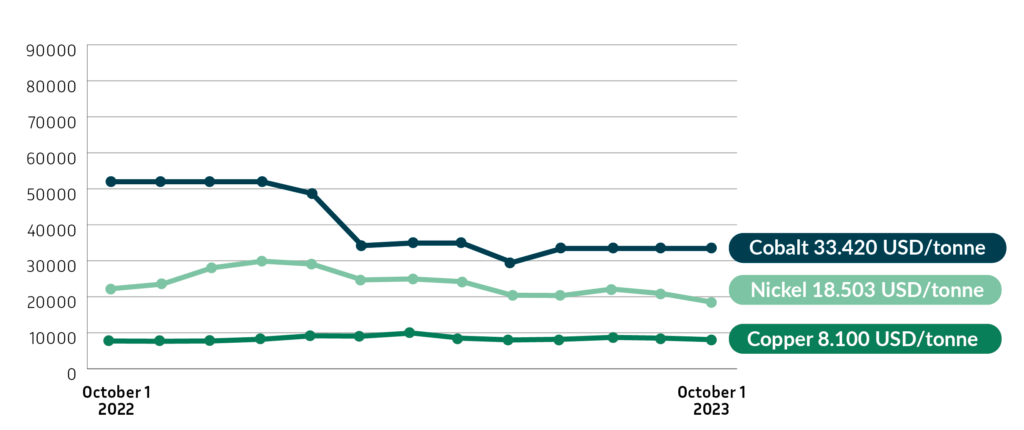

European Parliament approves Critical Raw Materials Act

The European Parliament has approved the European Critical Raw Materials Act (CRMA). This is good news. But the work of the European institutions is really just beginning now. The CRMA is intended to ensure a sustainable and long-term supply of important raw materials - such as cobalt, nickel, copper or lithium - for EU countries and to reduce dependence on raw material imports from non-EU countries. Urgency is the order of the day. Due to the importance of this dossier, the European institutions are pursuing a very tight schedule. The inter-institutional trialogue negotiations will start soon, and an agreement on the final regulation should be reached before the end of the year. And then the CRMA must be filled with life immediately. Bilateral agreements with raw material supplier countries such as Congo, Chile, Namibia, Australia or Canada must be negotiated as quickly as possible. For as former Soviet President Mikhail Sergeyevich Gorbachev said, "Those who are late are punished by life."

At the same time, however, domestic mining must be reactivated and intensified. EU Internal Market Commissioner Thierry Breton recently spoke an unpleasant truth for Europe: The EU risks being ‘weaponized’ by other nations unless it moves urgently to close more trade deals for the supply of critical raw materials. “It’s fair to say that we lost. We lost our competitive edge in mining and in processing,” Breton said. “This is because we have fewer reserves than in other regions, administrative complexity, energy costs, but also because we have for too long considered that decarbonizing meant relocating outside of the EU, and this was wrong,” he added. It’s true: Securing approval permits for mining projects and processing plants takes a long time in the EU, putting the bloc at a competitive disadvantage.

It sets a target for the EU to process at least 40% of its annual consumption of raw materials by 2030. “We are now clear that in the EU we cannot replace a fossil fuel dependency with a raw material one,” Breton said. The warning came as Australian resources minister Madeline King tours Europe to promote her government as a reliable trade partner. King warned the EU risks “missing the boat” if it doesn't move as quickly as its competitors. Well, since Noah built his ark, we know: Whoever misses the boat will not survive!"

Australia warns European Car Manufacturers

An investment in securing resources is an investment in the competitiveness and thus the future of European car manufacturers. An entire continent supply about half of the world's lithium and is the fourth-largest exporter of rare earth oxides. Not only Asia - but also Australian mining companies are important players within the value chain of electric car batteries.

Australian Resources Minister Madeleine King recently emphasized in Brussel, that European car manufacturers must invest in securing supplies of critical minerals if they are not to fall behind the competition. King then visited Paris, where she signed an agreement with the French Minister for the Energy Transition, Agnès Pannier-Runnacher. Under the agreement, France and Australia will cooperate on supply chains for critical minerals to ensure the supply of important strategic minerals. King's itinerary continued to Berlin, where she explored opportunities for bilateral cooperation on critical minerals with Volker Treier, Chief Executive of the German Chamber of Industry and Commerce.

Australia is thus responding to Chinese dominance by investing in its own processing capacities. However, the country is dependent on foreign investors to provide the necessary capital. With Eurobattery Minerals, we offer a way for car manufacturers to get responsibly mined minerals. But overall like-minded countries should coordinate to diversify the supply of raw materials and minimise dependence on China.

Madeleine King, Australia’s resources minister © Jono Searle/AAP/Alamy

Enjoy the last warm days of the year and the upcoming pumpkin season.

Svenska

Svenska

Deutsch

Deutsch